Why the EROI Model Is Essential in Modern Economics

A novel method for calculating Return on Investment (ROI) on Voluntary Carbon Credit Projects based on integrative systems biology; introducing the EROI (Environmental ROI)

Executive Summary: Why the EROI Model Is Essential in Modern Economics

The Environmental ROI (EROI) model, based upon bistable molecular models and integrated into Carbon Risk modelling by Billy Riuchares, is revolutionizing how economists and investors evaluate sustainability projects. Unlike traditional ROI, which measures only financial returns, EROI integrates economic value and environmental impact into a single framework—critical in an era of climate-driven markets.

This model links carbon mitigation, investment thresholds, and dynamic cost reductions using system-based equations. It captures real-world feedback loops: more investment boosts capacity and reduces costs, increasing EROI and attracting more capital. At the same time, it models risks such as carbon credit price drops that can erode returns. This systemic perspective allows for accurate forecasting in complex, nonlinear markets.

Key advantages:

Bridges Profitability and Sustainability: Aligns financial goals with climate targets.

Reduces Investment Uncertainty: Uses threshold-based decision points to optimize capital allocation.

Models Technology Learning Curves: Predicts cost declines as capacity scales, vital for renewables and carbon capture.

Adapts to Carbon Market Dynamics: Incorporates price fluctuations and policy impacts for robust valuation.

For economists, policymakers, and green investors, the EROI model is not optional—it’s essential. It transforms sustainability from a vague ambition into quantifiable, actionable economic strategy. In short, this tool equips decision-makers to drive profitable growth while meeting net-zero goals. Without it, sustainable finance would remain reactive; with it, the pathway to climate-aligned prosperity becomes clear.

Why the EROI Model Is a Game-Changer for Modern Economics

In an era where climate change economics intersects with financial viability, the Environmental ROI (EROI) model stands out as a vital tool for decision-making. This model does more than track returns—it integrates economic, environmental, and systemic feedback loops into a coherent framework. For economists navigating the transition to sustainable systems, this is not just useful—it’s indispensable.

1. Bridging Economics and Sustainability

Traditional ROI calculations work in purely monetary terms, ignoring environmental impact. The EROI model closes this gap by factoring in carbon mitigation alongside financial gains. It provides an equation where economic benefit per tonne of CO₂ mitigated and investment thresholds are explicitly tied to real-world outcomes. This allows economists to answer critical questions: Is this project both profitable and climate-positive? Without such tools, sustainability decisions risk being guesswork rather than data-driven strategy.

2. Capturing System Dynamics

The model’s use of Hill functions and feedback loops introduces systems thinking into economics. For example:

Positive Feedback: More investment → larger mitigation capacity → cost reduction → higher EROI → further investment.

Negative Feedback: Market saturation can lower carbon credit prices, reducing EROI and slowing capital flow.

This dynamic representation is essential in modern markets, where nonlinearity dominates. Economists need to understand tipping points, thresholds, and hysteresis effects, especially for sectors like carbon credits, renewable energy, and green infrastructure.

3. Investment Decision Precision

One of the biggest barriers in green finance is uncertainty. The EROI model reduces it by linking investment rates to performance thresholds (EROI_thresh) and maximum capacity growth (I_max). With this, economists can model scenarios: At what point does additional investment stop yielding economic or environmental value? It transforms abstract policy goals into actionable capital strategies.

4. Integrating Learning Curves

By including cost-learning exponents for CapEx and OpEx, the model realistically captures economies of scale. It predicts how technology costs decline as capacity grows—vital for sectors like biochar, carbon capture, and renewable energy. Economists can now forecast the inflection point where a project shifts from subsidy-dependent to self-sustaining.

5. Aligning with Carbon Markets

With global carbon credit markets expanding, accurate valuation methods are critical. The model directly ties mitigation capacity to economic value signals (V(t)), allowing economists to account for price volatility and policy shifts. This ensures investment decisions remain robust under fluctuating carbon pricing regimes.

Why Indispensable?

Modern economics isn’t just about maximizing profit—it’s about optimizing outcomes under planetary constraints. The EROI model provides a unified lens to assess profitability, environmental benefit, and systemic risk, all in one framework. For policymakers, investors, and sustainability strategists, this tool converts climate ambition into executable economic action. In short, without models like this, the path to a net-zero economy would be blindfolded guesswork. With it, the roadmap becomes clear.

Core State Variables

Mitigation Level: Cumulative CO₂ mitigated (tonnes CO₂)

Mitigation Capacity: Installed capacity for mitigation (tonnes CO₂/year)

Cumulative Investment I(t)I(t): Total invested capital ($)

Economic Value Signal V(t)V(t): Economic value per tonne CO₂ mitigated ($/tCO₂)

Key Dynamic ODEs (Novák-Inspired)

1. Rate of Mitigation

2. Capacity Dynamics

3. Investment Dynamics

dIdt=ImaxEROInEROIthreshn+EROIn(1−KKmax)dtdI=ImaxEROIthreshn+EROInEROIn(1−KmaxK)

Hill function captures threshold response (nonlinear switch)

ImaxImax: Max investment rate

EROIthreshEROIthresh: Threshold EROI triggering substantial investment

nn: Hill coefficient (steepness of switch, typically 2−52−5)

Environmental ROI (EROI) Metric

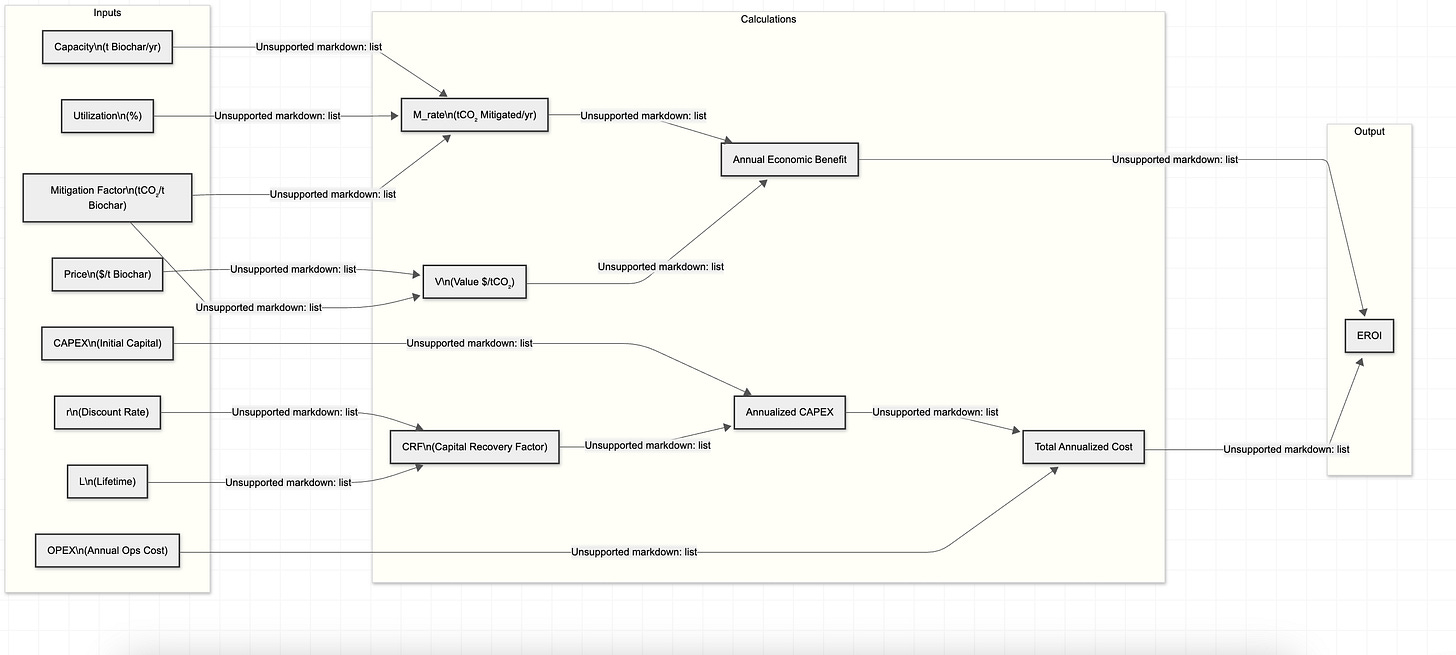

EROI(t)=Annual Economic BenefitAnnualized Capital Cost + Annual Operating CostEROI(t)=Annualized Capital Cost + Annual Operating CostAnnual Economic Benefit

Detailed:

Learning Curve Costs

Capital Cost (CapEx)

Ccap(K)=Ccap,0(KK0)−bcapCcap(K)=Ccap,0(K0K)−bcap

Operating Cost (OpEx)

\(\begin{align} C_{op}(K) &= C_{op,0}\left(\frac{K}{K_0}\right)^{-b_{op}} \end{align} \)where

Failed to render LaTeX expression — no expression found

Cop(K)=Cop,0(KK0)−bopCop(K)=Cop,0(K0K)−bop

bcap,bopbcap,bop: Learning exponents (typical range 0.07–0.23)

Key Feedback Loops and Dynamics

Positive Feedback: More investment → more capacity → cost reduction → higher EROI → more investment.

Negative Feedback: More mitigation → potential market saturation → lower price → lower EROI → reduced investment.

Threshold and Hysteresis: High initial thresholds for investment; once crossed, mitigation is sustained even if EROI dips slightly.

WORKED EXAMPLE

Here’s the detailed calculation with the explicit Environmental ROI (EROI) equation, clearly laid out step-by-step:

**Environmental ROI (EROI) Equation:**

Expanding this we have:

Where:

Calculation Steps with Values

Step 1: Calculate CRF

Step 2: Annualized CAPEX

Step 3: Annual CO₂ Mitigation

Given:

* Biochar produced: 350,000 tonnes/year

* Capacity Utilization: 90% (0.9)

* Mitigation factor: 2.5 tonnes CO₂ per tonne biochar

Step 4: Economic Value (V)

Biochar sale price: $150/tonne biochar. Converting to per tonne of CO₂ mitigated:

Step 5: Annual Economic Benefit

Step 6: Annualized Cost of Mitigation

Final EROI Calculation:

Final Result:

This clearly demonstrates a strong economic and environmental return under your specified scenario.